Introduction

We live in a time when threatened or combined cyber security is something that any growing business needs to consider integrating within its systems or policies. Fortunately, there is always cyber security insurance that can offer coverage in case a business falls victim to cyber breaches, ransomware, or other types of cyber risks. In the following paragraphs, we will go through the ten leading cyber insurance firms of the year 2025 that will prove to be beneficial for protecting your business and its operations against potential data breaches.

Free Make Money Online Micro Job & Best Freelancing Site

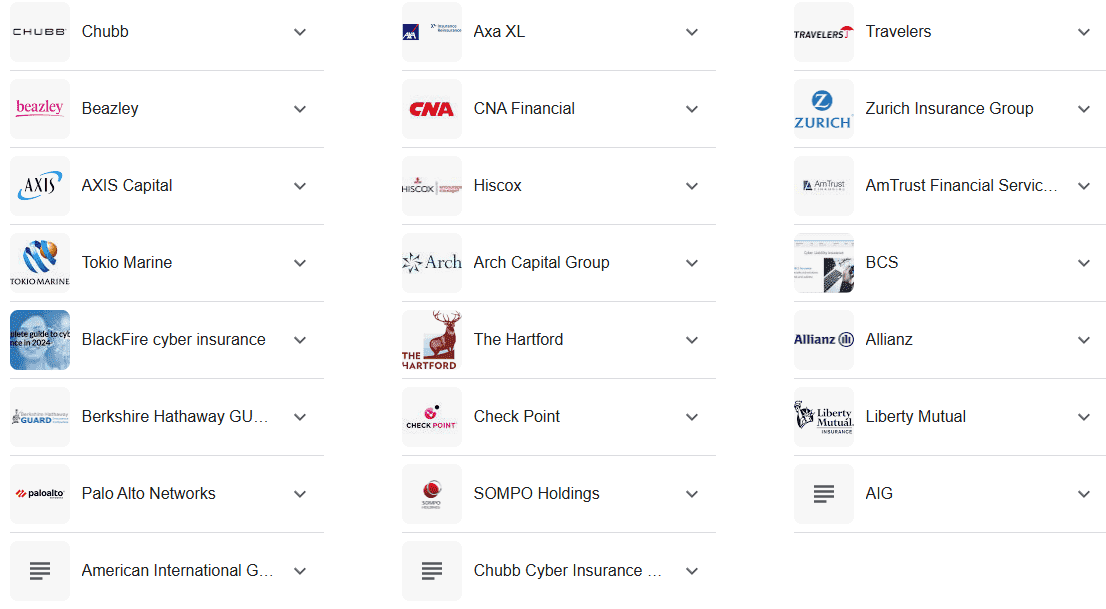

Ten Best Cyber Insurance Companies to Secure Your Data

i. Chubb Cyber Insurance (USA)

Why Choose Chubb?

When it comes to cyber security insurance and coverage for both small businesses and larger enterprises, Chubb is the leading name internationally.

Key Features:

- Covers data loss due to multi-network security or even cyber extortion incidents.

- Provides access to tools to manage cyber risk.

- Offers an incident response in order to minimize potential threats.

ii. AIG CyberEdge (USA)

Why Choose AIG CyberEdge?

AIG’s CyberEdge guards you against evolving threats and attacks while also having the tools at hand to tackle the cyber threat if it emerges.

Key Features:

- Fines and legal expenses against specific policies are included under AIG CyberEdge insurance.

- Reinforced team available dedicated to breach response.

- A declarative team is available to conduct risk assessments and monitoring during cyber breaches.

iii. Hiscox CyberClear (UK)

Why Choose Hiscox?

Policies that are efficient and easy to understand and are beneficial for SMMEs are easily available with Hiscox Cyber Clear.

Key Features:

- Services for retrieving and restoring data.

- Coverage for loss of revenue and damage to reputation.

- Consulting services for pre-breach mitigation.

iv. Allianz Cyber Protect (Germany)

Why Choose Allianz?

Allianz is a firm that is recognized throughout the world boundaries for its exceptional and cutting-edge cybersecurity solutions designed for all sectors.

Key Features:

- Extensive limits for cyber liability and crime.

- Worldwide incident management team.

- Employee training to minimize risks.

v. Travelers CyberRisk (USA)

Why Choose Travelers?

Businesses irrespective of their sizes will find the covers from Travelers CyberRisk suitable to them as it offers a variety of types of covers to suit them.

Key Features:

- Covers for fraud, data breach, and exposure differences.

- A cyber response unit.

- Policy types relevant to the industry.

vi. AXA XL Cyber Insurance (France)

Why Choose AXA XL?

Multinational companies will find XEM as an ideal option as they apply a local approach to their issues while at the same time using global knowledge.

Key Features:

- Solutions customized to meet the needs of specific functions.

- Full data protection and liability cover.

- Real monitoring of changing risk environments through the use of timely alert systems.

vii. Beazley Breach Response (UK)

Why Choose Beazley?

Beazley was among the first to take a stake in cyber security insurance, and this stake will always set a dynamism of both forward and backward in relation to breach management.

Key Features:

- Covers the costs of notifications, retention of legal counsel, and payment of penalties.

- Has a dedicated breach response team.

- Risk management planning by use of preventative measures.

viii. Zurich Cyber Insurance (Switzerland)

Why Choose Zurich?

Insurance A solution comprises a combination of Zurich's Professionals and Security in addition to their Claims Department.

Key Features:

- ZICS & ZCPC Both secure cover from $2M.

- Global cyber coverage includes breaches of data security and systems theft.

- Support services for compliance auditing and regulatory policies.

ix. CNA CyberPrep (USA)

Why Must You Pick CNA?

CyberPrep by CNA ensures full-spectrum protection along with instruments necessary for improving cyber resilience.

Key Features:

- Protection against ransomware, phishing, and other third-party risks.

- Employee training modules.

- Thorough and comprehensive incident handling plans.

x. Liberty Mutual Cyber Insurance (USA)

Why Must You Pick Liberty Mutual?

Liberty Mutual designs forward-thinking and flexible policies that cover general and new domains of cyber threats and attacks.

Key Features:

- Coverage for loss of information, damage to a system, and other extremes such as blackmail.

- Dedicated solutions targeting the insurance, retail, and banking industries.

- Contact a specialist in cyber security for rapid mitigation.

Conclusion

As cyber threats continue to evolve in complexity, the need for cyber insurance has become imperative. The companies outlined herein are some of the most established in the industry, providing you with bespoke services that protect your organization from financial and reputational losses. More importantly, by working with a suitable company, you can continue expanding the business while being protected from cyber liability.

Top 10 Leading Motorbike Manufacturer Companies

Selecting the Most Reliable Cyber Security Insurance Provider.

- Assess Coverage Requirements: A business should be aware of its risks and should find a vendor that is able to provide the capacity that it wants and needs.

- Check for Incident Response Services: A business should seek out companies that offer 24/7 phone support and quick action when there is a threat, such as a data breach.

- Assess Global Presence: In case your business is global, check out the broad presence of expertise of the provider.

- Check pricing for services: Check out the price of services and ensure that they are not financially burdensome.

Ten Best Mobile Phone Technologies

FAQs

What is cybersecurity insurance?

It is a type of policy that aims to protect industries from monetary losses in the event of a cyberattack and a data leak.

Do small businesses need cyber security insurance?

Definitely, small businesses are often the lowest-hanging fruits for cybercriminals; hence, these businesses can take advantage of this coverage.

What does cyber security insurance typically cover?

Losses due to security breaches, ransom demands, business-related legal expenses, administrative penalties, and marketing costs are included.

How much does cyber security insurance cost?

Annual rates range from $500 to over $10,000. However, they fluctuate based on the size of the business, the sector in which they operate, and the extent of insurance they require.

Which company offers the best global coverage?

For businesses that undertake operations around the globe, Allianz and Zurich are great companies to consider working with.

Leave a Reply