Ten Best Life Insurance Investment Companies 2025

Life Insurance as an Investment

Life insurance is not only intended for the financial support of one’s dependents but can also be fundamental in building assets. The investment-linked life insurance policies bring together protection and growth of wealth, enabling the policyholders to secure their future while still augmenting their financial portfolio.

Why Identify the Best Life Insurance Investment Provider in the Market

Most people are looking for a life insurance policy provider or a life insurance policy that allows both protection and expansion of one’s financial prospects. The companies that have decent returns, good policies and good customer service will ensure that the money invested by you will begin to multiply and also look after your family's future.

Ten Best Business Insurance Companies

What are the essential elements in life insurance policies with investment cover?

The following are some considerations when thinking about investment life insurance that includes the following features:

Investment Clusters: Consider devices that have other flexible investment policies, such as mutual funds, stocks, and bonds.

Customization: Go for providers that offer plans that can be tailored according to one’s expectations.

Duration & Reputation: Try and target companies whose duration and reputation have both been consistent in return.

Transparency Credibility: The policies are to be clearly defined as far as applicable fees, returns and risks are concerned.

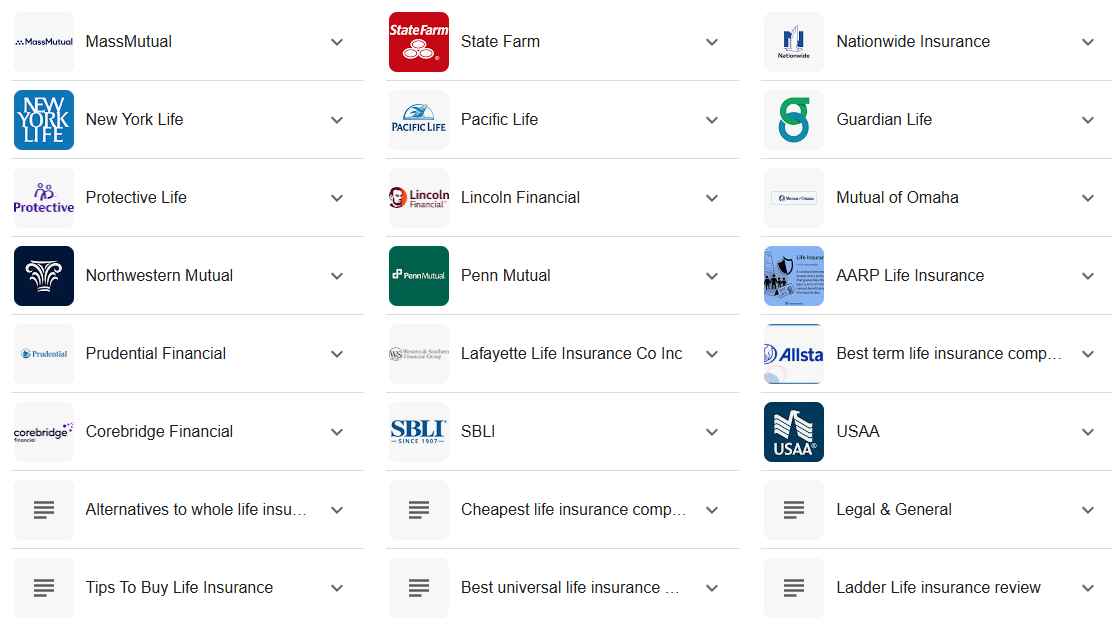

Ten Best Life Insurance Investment Companies 2025 for Secure Financial Growth

i. Prudential Financial, United States of America

Prudential Financial Offers Life Insurance in Investment Perspective

Prudential Financial, through its various life insurance policies, also has a policy where the investors can buy variable life insurance, which stands as life coverage, and the client can invest in various funds.

Deviatečina Investigatora Nikolevanca, vosotros Veežtri, Tatyana, Maeroz yu Vútdíž kyotongos Fíyđe and Fuŵey, samálur equilí y rockji tenga keen sitä.

Prudential also has options for investments in equity, fixed income, and balanced funds, which are suitable for investors with different levels of risk.

ii. Allianz SE (Germany)

Reputable Global Provider of Financial Services

Allianz is a renowned name that offers plans with investment-linked life insurance worldwide.

All-Inclusive Investment and Protection Plans

Its unit-linked policies are intended for overachieving wealth growth together with adequate life coverage.

iii. MetLife (United States)

Provider of Variable and Universal Life Insurance Policies

MetLife has been able to stand out by providing investment-linked policies to clients to reach investment goals and protect loved ones.

Attractive Returns on Investments

Policyholders with MetLife can gain access to various funds that ensure good returns on investment and plans that meet specific objectives.

iv. AXA Group (France)

Broadening Scope of Operations With Relevant Investments

AXA life insurance policies are highly personalized offerings, as they blend professionalism with the needs of their clients.

More Customers and Unique Investment Junctions

AXA clients can find its policies easily because of AXA’s investment-linked life insurance’s clear policies and relations with customers.

v. LIC (Life Insurance Corporation of India)

Leader in Indian market

LIC's legacy, as well as its large number of customers, affirms it as a trusted life insurance investment policy provider.

Attractive Policies with Potential for Long-Term Growth

It’s popular for ULIP and endowment plans, which can provide life cover along with investments that grow over the long term.

vi. Manulife Financial Corporation (Canada)

Flexible Investment-Linked Life Insurance Products

The company meets the needs of people looking to combine protection and investment with its wide range of offerings.

Strong Focus on Customer Needs

As for the customers, their important life goals are taken into consideration by Manulife in terms of their different plans for multiple life stages and financial targets.

vii. AIA Group (Hong Kong)

Leading Life Insurance Provider in Asia-Pacific Region

AIA has built a niche in the integrated savings and protection plans, which puts it at a competitive advantage within the Asia-Pacific region.

Integrated Savings and Protection Plans

The plans combine features where capital appreciation is sustained while providing top-of-the-line coverage in the event of death.

viii. Aviva (United Kingdom)

Known for Unit-Linked Insurance Plans (ULIPs)

Aviva’s plans allow policyholders the opportunity to diversify across a number of funds while seeking maximum returns and security.

Focus on Wealth Growth and Risk Management

In the world of Aviva, the objective is to develop an economy while minimizing the risk altogether within the investment sector.

ix. Zurich Insurance Group (Switzerland)

Customizable Life Insurance Investment Options

Zurich’s life insurance investment-connected products are made available in accordance with the client’s ideal perceptions and expectations.

Expertise in Financial Planning

Zurich integrates effective life cover with optimal financial planning to enhance client returns.

x. Sun Life Financial (Canada)

Versatile investment-linked plans

Sun Life has a broad spectrum of investment options, varying from mutual funds to focused retirement plans, catering to the wider populace.

Reputable for retirement funds

The benefits of these policies are significant for persons planning towards a future retirement.

Conclusion

As a way of investing funds in life cover, it is possible to secure one's family destiny as well as increase personal wealth. Prudential Financial, Allianz, MetLife, AXA, LIC, Manulife, AIA, Aviva, Zurich and Sun Life are some of the companies that are recognized for their creativity, clear policies, and more business-oriented outlook. When a suitable provider is chosen, the insured is assured of a sense of security and an expeditious influx of wealth.

Ten Best Cyber Insurance Companies to Secure Data

How To Pick The Most Suitable Life Insurance Investment Company

To find the life insurance that fits your needs, do the following:

Clarify Your Aim: Find out whether you focus your efforts on building wealth, retirement, or family security.

Policies Benchmarking: Compare investment policies, fees, and returns of numerous companies.

Assess Reputation: Choose insurers who have been known to give their clients the desired result along with timely responsiveness.

Professional Help: Reach out to consult financial representatives to make sure policies fit within the financial plans.

Free Make Money Online Micro Job Site

Frequently Asked Questions

What is investment-linked life insurance?

It’s a policy that allows money holders to secure their lives and, at the same time, expand their wealth through investment opportunities.

Which life insurance company has the most competitive investment-linked policies?

Prudential Financial, Allianz and MetLife are some of the insurance providers with competitive investment-linked policies.

Are unit-linked insurance plans (ULIPs) worth buying?

Of course, ULIPs offered by providers such as Aviva and LIC are great for long-term growth, with options to switch between asset classes depending on market conditions or personal risk appetites.

What would you cite as an important factor for me to consider before selecting one of the life insurance companies?

Factors such as the following should be considered: This type of insurance comes with several options: investment options, policy charges, customer ratings, financial history, and outlook.

Can any type of life insurance be regarded as a retirement policy?

Of course, companies such as Sun Life Financial and Zurich have policies designed in such a manner to enable policyholders to retire comfortably.