Ten Best Payment Gateway Companies for Secure and Seamless

PAYMENT GATEWAY COMPANIES: LET´S START

Payment gateways are a tool enabling customers to make online payments to businesses in a safe manner. It streamlines how payments are processed and maintains both the privacy of information and the confidence of the clientele. Free Temp Mail, Ten Best Banks in the World

Potential Gateways for Payments: TO BUSINESS OR NOT TO BUSINESS?

In a world where everything is digital, a payment gateway increases customer trust, minimizes the number of failed transactions, and enables faster checkouts, which is necessary for a better interaction experience.

FACTORS IN CHOOSING THE RIGHT PAYMENT GATEWAY

Some of these factors are:

- Rates: Maximizing performance while reducing costs.

- Availability: Different currencies and cross-borders.

- Flexibility: joining your website or app.

- Safety: conformance to PCI-DSS requirements and battle against fraud.

HIGH LEVEL PAYMENT GATEWAY OFFERING

- Multiple currencies: Customize payments in every region of the world.

- Safety: state-of-the-art encryption and fraud explorer.

- Various payments: credit card, wallet, BNPL.

- Mobile: Foster mobile user experiences however way you please.

Ten Best Payment Gateway Companies for Secure and Seamless

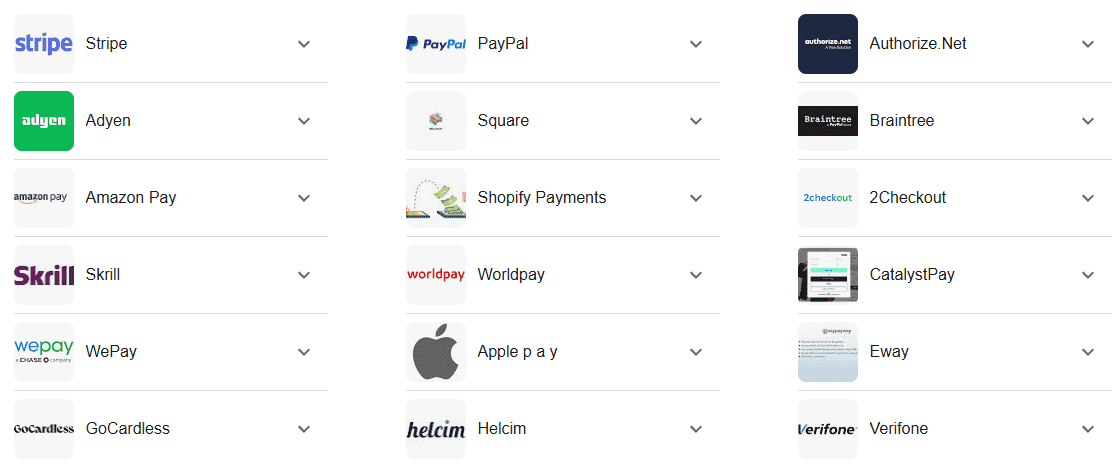

1 *** PAYPAL (Worldwide): COUNTLESS CONFIDENTIALITY

The future is bright.

Trust is given. Security is what everyone wants, and that’s why PayPal is used more widely by ordinary people and businesses alike, as it is one of the best known payment gateways.

Core strengths

- Support for many currencies.

- Buyers protection and sellers protection.

2 *** Stripe ( Global )

Offers a unique and customizable

API that works best for businesses and merchants who want a unique payment experience.most suitable payment gateway for your international business in terms of trade.

Core strengths

- Tools for a sophisticated approach to prevent fraud.

- Supports the subscription models and the marketplaces.

3 *** Square (United States)

Best for Smes

Square is king in processing offline and online payments, which suits well smes. Pick the most suitable payment gateway for your international business in terms of trade.

Key Features

- Reporting and integrated POS systems.

- Fixed margin percentage pricing.

4 *** Adyen (Global)

Best suited for enterprises

Seamless payment services are what made Adyen a preferred choice for large companies like Uber and Spotify.

Key Features

- Numerous currencies and numerous channels are available.

- Sophisticated technology prevents fraud in perfect time.

5 *** Razorpay (India)

Has gained popularity in this location

Razorpay is a forward-looking insurance gateway that offers anything from conventional setups to subscriptions and UPI-based integration.

Key Features

- Simple registration procedure for online business enterprises.

- The Indian market facilitates diversified payments to suit various customers.

6 *** Authorize.Net (United States)

The trusted Old Timer

With the evolution of other more advanced designers, Authorize.Net is still relevant as one of the first payment gateways and still provides services to SMEs.

Key Features

- Outstanding support service.

- E-commerce integration made easy and fast.

7 *** WorldPay by FIS (Global)

The Global Transactions specialist

WorldPay specializes in international payments, enabling businesses to be able to expand globally.

Key Features

- Wide range of payment options.

- Fast and safe international payment solutions.

8 *** Payoneer (Global)

Ideal for Freelancers and SMBs

Small businesses and freelancers love Payoneer as it provides affordable cross-border payment services.

Key Features

- Cross-border payments have low fees.

- Easy way to get money from local bank accounts.

9 *** Klarna (Europe)

Global leader in BNPL Services

Klarna is the clear leader in the Buy Now, Pay Later area. It is the original point of purchase and offers customers the option to pay over time.

Key Features

- Great for online shopping.

- Eg., Grace period facilities for users.

10 *** CCAvenue (India and Global)

Exclusively Suitable for Indian Businesses

These include net banking, wallets, and credit cards in CCAvenue.

Key Features

- Multiple currencies are accepted.

- Chargebacks are available in different languages.

How to Choose the Right Payment Gateway for Your Business

- Understand Your Needs: Determine your business and customers’ main transactions.

- Look at the Costs: Compare setup and transaction costs, including ongoing maintenance charges.

- Consider the Scalability: Examine the growth potential of the business, thus the gateway.

- Evaluate the Usability: Ensure that customers do extensive research that will eliminate any issues with ease of payment.

Conclusion

The process of making a purchase over the internet is both general and very specific, and so finding the right payment gateway is of utmost significance. Companies are able to leverage solutions, such as Paypal, Stripe, Razorpay, and Adyen, which are designed to fit their objectives, heightening their satisfaction and improving their operations at the same time.

Top 10 Best Free AI Image Generator Online

FAQs

Which payment gateway is best suited for a global business?

Adyen and Worldpay are best suited for the international ones.

What is the highest-security payment gateway?

It is a well-known fact that Stripe and PayPal have sophisticated hacking measures to prevent any malicious invasions.

Which gateway is more suitable for small businesses?

Square and Razorpay are the best suited for small to medium enterprises to large businesses.

Am I allowed to use more than one payment gateway?

Yes, a lot of businesses use multiple gateways as it gives them a wider reach and flexibility.

Is mobile optimization also required for a payment gateway?

Yes. Mobile customers’ satisfaction and cart abandonment rate are improved with a mobile-optimized gateway.